Banking services for children and young people

Are you setting up banking services for a child? You can open a Current Account and order a debit card for a child conveniently online. A Child's Current Account and card are great tools for learning how to manage money.

Apply for services for a child Accept other guardian's application

How to open an account, order a card or get a user ID for a child

You can open a Current Account or order a card for a child by submitting an application. If the child is already an OP customer, you can order a card for the child’s existing account. A child over 7 years can also get an OP user ID for digital services at a branch. Banking services are free of charge for children and young people.

-

1.

Fill in an application

You can submit an application if you have an OP user ID. Select the services you want to enable for the child in the application.

-

2.

Other guardian accepts the application

Once all guardians have accepted the application, we'll activate the services. We'll send you a summary by message on OP's service.

-

3.

Card will arrive by post – pick up OP user ID from a branch

The debit card and its PIN will arrive at home within 1–2 weeks. The user identifiers must be picked up from a branch by appointment.

Banking services for different age groups

Banking services are free of charge until you turn 26.

Aged 0–6

Open an account for the little one and start systematic investing for the child.

-

You can open a Current Account as soon as the child's name has been registered. The guardians will have extensive access rights to the account opened by submitting an application, and the child's account will show on the guardian's OP-mobile and op.fi service when they are logged in. Open a Current Account by filling in an application for banking services for a child.

-

You can enrol a child as an OP cooperative bank owner-customer by paying the member cooperative contribution, which is 100 euros in most OP cooperative banks. There are no other membership fees. As an owner-customer, the child gets 0.25% interest on their Current Account.

You can invest in funds and stocks for the child when the child has their own Current Account. To invest in stocks, you'll also need a Book-entry Account or Equity Savings Account. Every child born in 2025 will receive an investment from us, worth 100 euros, in the OP-World Index fund.

Aged 7–11

A primary school pupil's own debit card makes everyday life and hobbies easier.

-

The guardians will have extensive access rights to the account opened by submitting an application, and the child's account will show on the guardian's OP-mobile and op.fi service when they are logged in. Open a Current Account by filling in an application for banking services for a child.

-

You can apply for the card together with the child.

You will need:

- A photo of the child’s valid Finnish passport or identity card.

- The child's personal mobile phone that can receive SMSes. A watch phone is not suitable for this purpose.

If the child doesn't have a phone, you can apply for the card at a branch by appointment.

-

The child, producing a valid passport or identity card, can get banking user identifiers from a branch by appointment.

One guardian must accompany the child at the bank branch. A power of attorney is required from any other guardians. You can provide the power of attorney at the same time as you open an account or apply for a card.

-

You can enrol a child as an OP cooperative bank owner-customer at the same time as you open an account or apply for a card. The child becomes an owner-customer when you pay the member cooperative contribution, which is 100 euros in most OP cooperative banks. As an owner-customer, the child gets 0.25% interest on their Current Account.

You can invest in funds and stocks for the child when the child has their own Current Account. To invest in stocks, you'll also need a Book-entry Account or Equity Savings Account. Every child born in 2025 will receive an investment from us, worth 100 euros, in the OP-World Index fund.

Aged 12–14

A lower secondary school pupil can already handle things like health matters alone.

-

The guardians will have extensive access rights to the account opened by submitting an application, and the child's account will show on the guardian's OP-mobile and op.fi service when they are logged in. Open a Current Account by filling in an application for banking services for a child.

-

You can apply for the card together with the child.

You will need:

- A photo of the child’s valid Finnish passport or identity card.

- The child's personal mobile phone that can receive SMSes.

A card held by a person over the age of 13 can be added to Apple Pay in Customer Service.

-

The youth, producing a valid passport or identity card, can get banking user identifiers from a branch by appointment.

When the child has turned 12, they can be granted strong electronic identification means for using services like MyKanta. The guardians will no longer see all of the child's health information. You can update the banking user identifiers only at a branch by appointment.

One guardian must accompany the child at the bank branch. A power of attorney is required from any other guardians. You can provide the power of attorney at the same time as you open an account or apply for a card, or on the op.fi service with Power of teh attorney for minor's banking

-

You can enrol a child as an OP cooperative bank owner-customer at the same time as you open an account or apply for a card. The child becomes an owner-customer when you pay the member cooperative contribution, which is 100 euros in most OP cooperative banks. As an owner-customer, the child gets 0.25% interest on their Current Account.

You can invest in funds and stocks for the child when the child has their own Current Account. To invest in stocks, you'll also need a Book-entry Account or Equity Savings Account. Every child born in 2025 will receive an investment from us, worth 100 euros, in the OP-World Index fund.

Aged 15–17

A young person becoming independent needs a user ID to access digital services.

-

The guardians will have extensive access rights to the account opened by submitting an application, and the child's account will show on the guardian's OP-mobile and op.fi service when they are logged in. Open a Current Account by filling in an application for banking services for a child.

The young person, using their OP user ID, can also themself open an account for their personal income, such as wages, study grant or pocket money.

-

You can apply for the card together with the child.

You will need:

- A photo of the child’s valid Finnish passport or identity card.

- The child's personal mobile phone that can receive SMSes.

-

The youth can get new, extended banking user identifiers from a branch by appointment. This requires the guardians' consent and a valid passport or identity card.

You can give your consent at the same time as you open an account or apply for a card, or on the op.fi service with the general power of attorney.

With their user identifiers, the youth can use OP-mobile and the op.fi service as well as make purchases online and in apps. They can also access important services, such as Kela, MyKanta, the joint application system and entrance exams for schools.

-

You can enrol a child as an OP cooperative bank owner-customer at the same time as you open an account or apply for a card. The child becomes an owner-customer when you pay the member cooperative contribution, which is 100 euros in most OP cooperative banks. As an owner-customer, the child gets 0.25% interest on their Current Account.

Young persons aged 15 and over can save and invest independently with their guardians' consent.

Using a card and banking user identifiers as a child

Smart spending starts with your own card

A child can practice use of money safely with a debit card. When paying with a debit card, the card's balance is checked, and the payment is charged directly from the account.

-

OP Basic is suitable for children over the age of 7. You can't overdraw an account with the OP Basic card. The card won't work if the card reader doesn't have Internet access.

-

The OP Debit card is intended for persons over the age of 15. However, you can overdraw your account with the OP Debit card, as you can pay with the card even if the card reader doesn't have access to the Internet.

Guardians should set suitable security limits for the daily use of the child’s card. We recommend that parents sign powers of attorney for managing a minor's banking matters. A power of attorney is required for changing a card's security limits. However, if the young person has their own OP user ID, they can change the security limits themself.

Read more about OP's debit cards

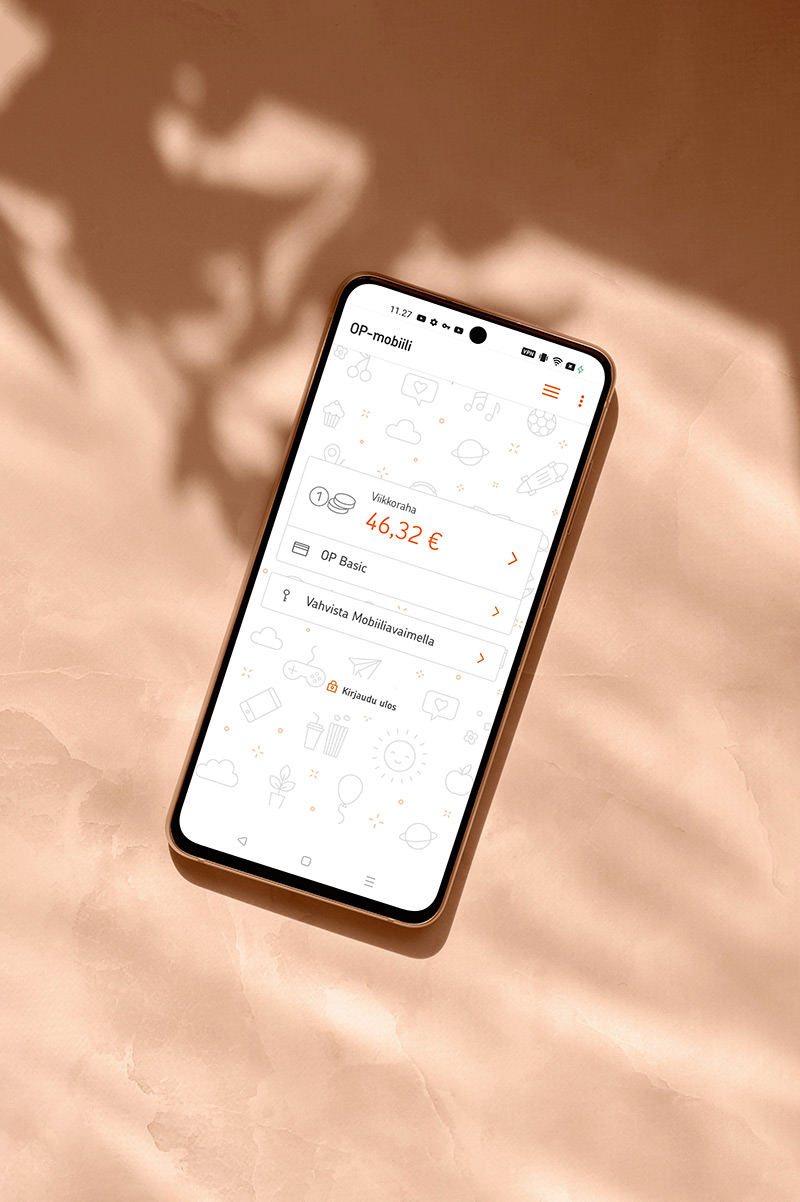

Child-friendly OP-mobile

A young person under 15 can keep track of their account transactions and balance on OP-mobile. They can also confirm purchases and card payments online and in apps by using Mobile key.

On OP-mobile, the child can see all accounts that they have the right to access and can use these accounts. When also the parents have access rights to the child's account, they can see the account in their own OP digital services. A parent can also make credit transfers into the child's account and keep track of the child's account transactions.

The child won't be able make credit transfers on OP-mobile. Neither will the child see their investments, allowing them to practice money matters with the daily services only.

Read more about OP-mobile

Turning 15 brings more services

When a young person gets banking user identifiers at the age of 15, they get a more extensive access to OP's digital services.

They can make credit transfers and change their card's security limits. They can use the My finances tools on OP-mobile and also see more information than before about their accounts used for investment.

With their parents' or guardians' consent, the child can save and invest independently on the digital services.

It is very important to the young person's future that they keep their finances and credit history in order, so parents should support their child in developing money skills.

Independent banking at 15Read more about our services for minors

Saving for a child

By saving for your child, you secure your child's future financially and give them the freedom to follow their dreams. Every baby born in 2025 will receive an investment from us, worth 100 euros, in OP-World Index fund.

Read more about saving for a child

Hippo Club

The Hippo Club is designed for the children as our customers members aged 3–8 years without a membership fee. The goal of Hippo activities and events is to promote active family time and support smart everyday choices.

Read more about Hippo Club

Child insurance

With your child, you never know what’s going to happen next. When your child is hurt or falls ill, you do not feel like queueing to see the doctor or have an examination. A child insurance enables your child to have the best possible treatment without having to wait for it, also privately.

Read more about child insurance