Pay for things the easy way

Pay handily at the checkout, online and to friends. Our daily services package includes one or two cards, an account, and OP User ID and digital services. Your card can double as a K-Plussa loyalty card — just have K-Plussa added, free of charge.

Keep your finances on the right track

Being a customer of OP entitles you to more than just a card, account and digital services: you can use our range of services for managing your finances and saving. These include My financial balance and Money Box.

Security if surprises occur

As an owner-customer, you get Product Protection Insurance cover, free of charge, for purchases made with the OP Classic, OP Gold or OP Platinum card.

Daily services packages

The price of the daily services package includes all daily transactions, and there are no monthly or annual charges associated with using the services. Those under 30 years of age pay a discounted price for the services. These services are included in the owner-customer’s daily services package:

-

Current Account

-

OP’s user ID and digital services

-

Card you have selected

-

Credit / Debit

OP Gold

Most popularOwner-customer’s daily services package with OP Gold card

€8 per month

Charge for others €13.25 per month

FEATURES

-

Credit limit

2 000 - 20 000 €

-

Purchase Protection Insurance

Purchase Protection Insurance in accordance with the Consumer Protection Act

-

Product Protection Insurance

365 days

-

Travel Insurance

Yes

-

Additional services for travelling

Two free visits per year to an airport lounge, rental car insurance and emergency cash advance.

-

Event ticket insurance

Max. €1,000 per month

-

Own customer service

24/7

-

-

Credit / Debit

OP Classic

Owner-customer’s daily services package with OP Classic card

€3.95 per month

Charge for others €8.45 per month

FEATURES

-

Credit limit

2 000 - 20 000 €

-

Purchase Protection Insurance

Purchase Protection Insurance in accordance with the Consumer Protection Act

-

Product Protection Insurance

180 days

-

-

Debit

OP Debit

Owner-customer’s daily services package with OP Debit card

€3.95 per month

Charge for others €8.25 per month

Two cards for smooth payments

OP Duo credit card is the smart choice of second card. Pay for daily shopping with one card and use the other for online buys and streaming services.

-

Paying with a credit card is smart and secure. Having a second card can be an invaluable help if the card you normally use isn't working at a store or if it is lost or stolen.

-

It can make sense to use a second card for online purchases and streaming service payments. Then you can easily follow these payments and bills as they are separated from your other daily transactions.

-

Purchases you pay with OP Duo are covered by Product Protection Insurance.

Credit

OP Duo

OP Duo as part of the daily services package for owner-customers

€2 per month

Charge for others €4 per month

FEATURES

-

Credit limit

2 000 - 20 000 €

-

Purchase Protection Insurance

Purchase Protection Insurance in accordance with the Consumer Protection Act

-

Product Protection Insurance

365 days

-

F-Secure Scam Protection

Scam Protection helps you identify online scams before any harm occurs.

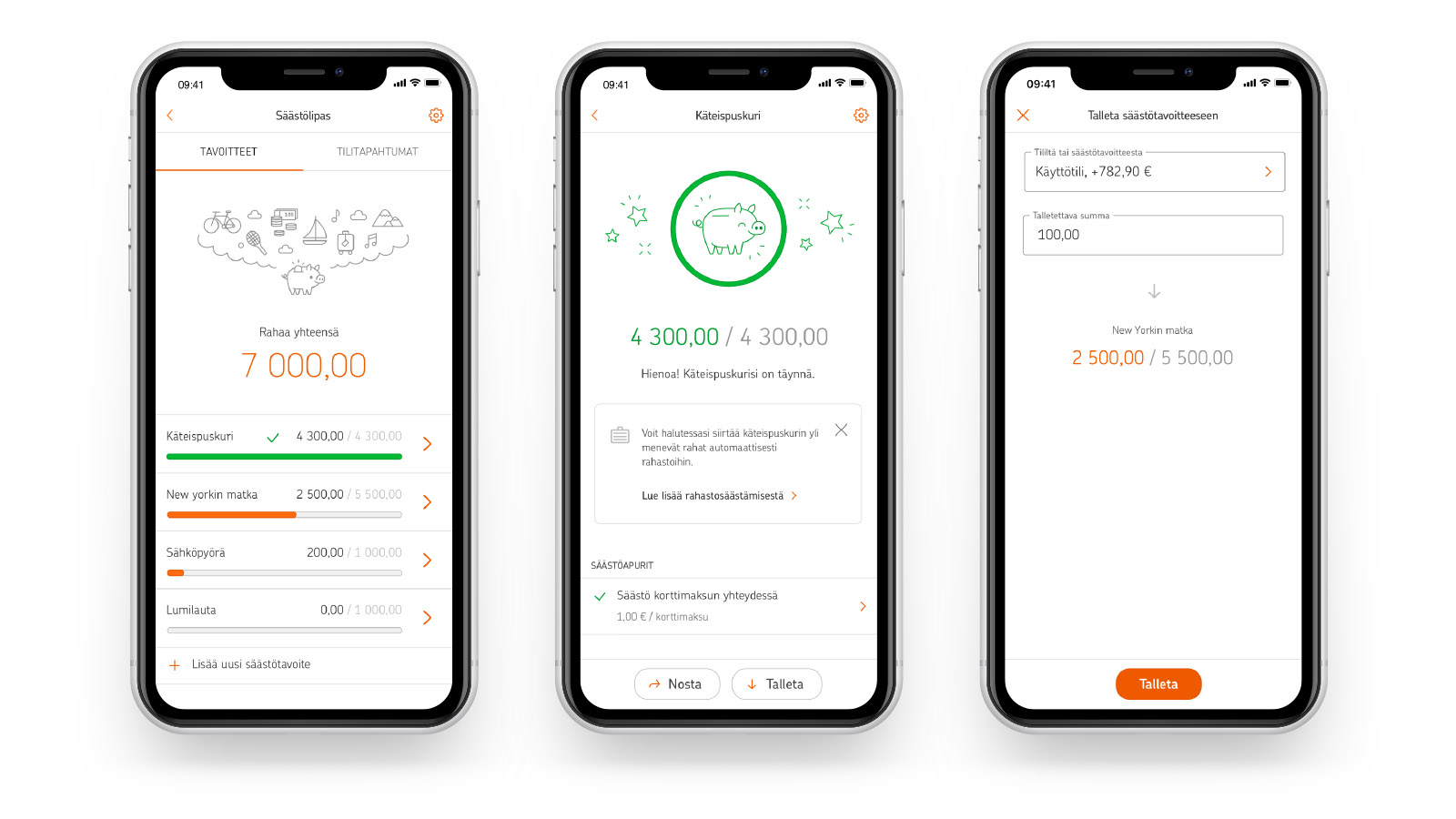

Tools for the management of personal finances and saving

Understanding your income and expenses is the foundation for managing your finances. Learn to manage your finances holistically.

-

Monitor your income and expenses conveniently on OP-mobile. Understand easily how much you spend on needs and wants.

-

Money Box lets you save for your everyday dreams and surprise expenses almost without you noticing. Specify a small amount that will be transferred to Money Box whenever you pay with your card.

-

The Savings Account is a flexible and easy account for productive saving. Transfer any extra funds in your Current Account to the Savings Account, for example. This is how you get a higher interest rate for your Savings Account.