Grönt lån

Finansiera projekt som minskar miljöbelastningen med vårt gröna lån.Trygga din plats i underleverantörskedjorna genom att uppfylla hållbarhetskraven

Storföretagen kräver att underleverantörerna satsar på hållbarhet, och de är redo att byta leverantörer på basis av hållbarhetsförpliktelserna.

Förbered dig på intressentgruppernas ökade förväntningar som en ansvarsfull aktör

Med hjälp av det gröna lånet kan ditt projekt profileras som hållbart, och du kan utnyttja det i kommunikationen med intressentgrupperna och för att bygga upp anseendet och arbetsgivarprofilen.

Lämpar sig för sme-företags, näringsidkares och bostadsbolags investeringar som minskar miljöbelastningen

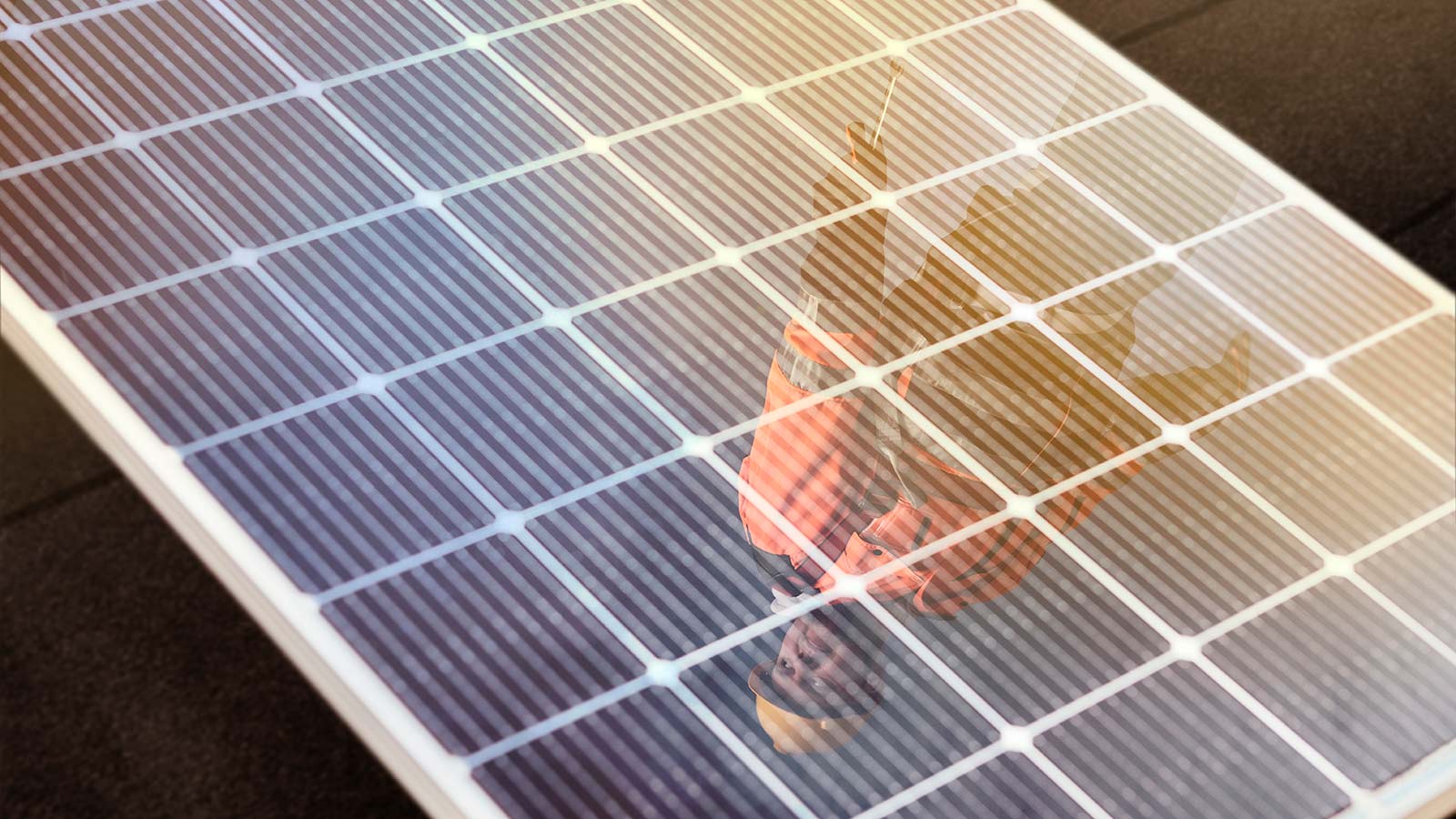

Grön finansiering är en lånelösning för att bygga upp en ansvarsfull affärsverksamhet. Med vårt gröna lån finansierar du olika investeringar som minskar miljöbelastningen, till exempel bygg- och renoveringsprojekt och grundliga renoveringar som förbättrar energieffektiviteten, laddningsställen för elbilar, eller projekt för förnybar energi och lagring av energi. Ett grönt lån möjliggör även investeringar som främjar cirkulär ekonomi.

Ansök om finansiering eller lämna en kontaktbegäran

Du kan fylla i en finansieringsansökan också i våra digitala kanaler.

Lämna en kontaktbegäran, så kontaktar vi dig inom några bankdagar.

Vad är grönt lån?

Ett grönt lån är ett lån för små och medelstora företag och bostadsbolag. Lånet stöder investeringar som minskar miljöbelastningen.

- Du kan få ett grönt lån om ditt projekt uppfyller kriterierna för grön finansiering. De här kriterierna baserar sig på ramverket OP Green Bond Framework.

- Ditt projekt kan profileras som hållbart och du kan utnyttja det i kommunikationen med intressentgrupperna och för att bygga upp anseendet och arbetsgivarprofilen. Ett grönt bostadsbolagslån är ett ansvarsfullt val för ditt bostadsbolag.

- Du får ett grönt lån förmånligare än ett vanligt lån.

- Vi kan be årliga uppgifter om dina investeringar, till exempel om elförbrukningen, så att vi kan bedöma de uppnådda miljöeffekterna. Att göra en anmälan är enkelt för dig.

För hurdana projekt går det att få ett grönt lån?

- renoveringar och totalrenoveringar som förbättrar energieffektiviteten,

- certifierade byggnader,

- utnyttjande av förnybara energikällor,

- utnyttjande av spillvärme (exempelvis för anskaffning av frånluftsvärmepumpar eller investeringar i industriell skala),

- lagring av energi,

- byggande av utsläppssnål infrastruktur för trafik (till exempel montering av laddstolpar och anknytande elarbeten),

- ekologisk odling eller täckdikning av odlingsmarker.

Grönt lånet beviljas av andelsbanken.