Responsible investment funds

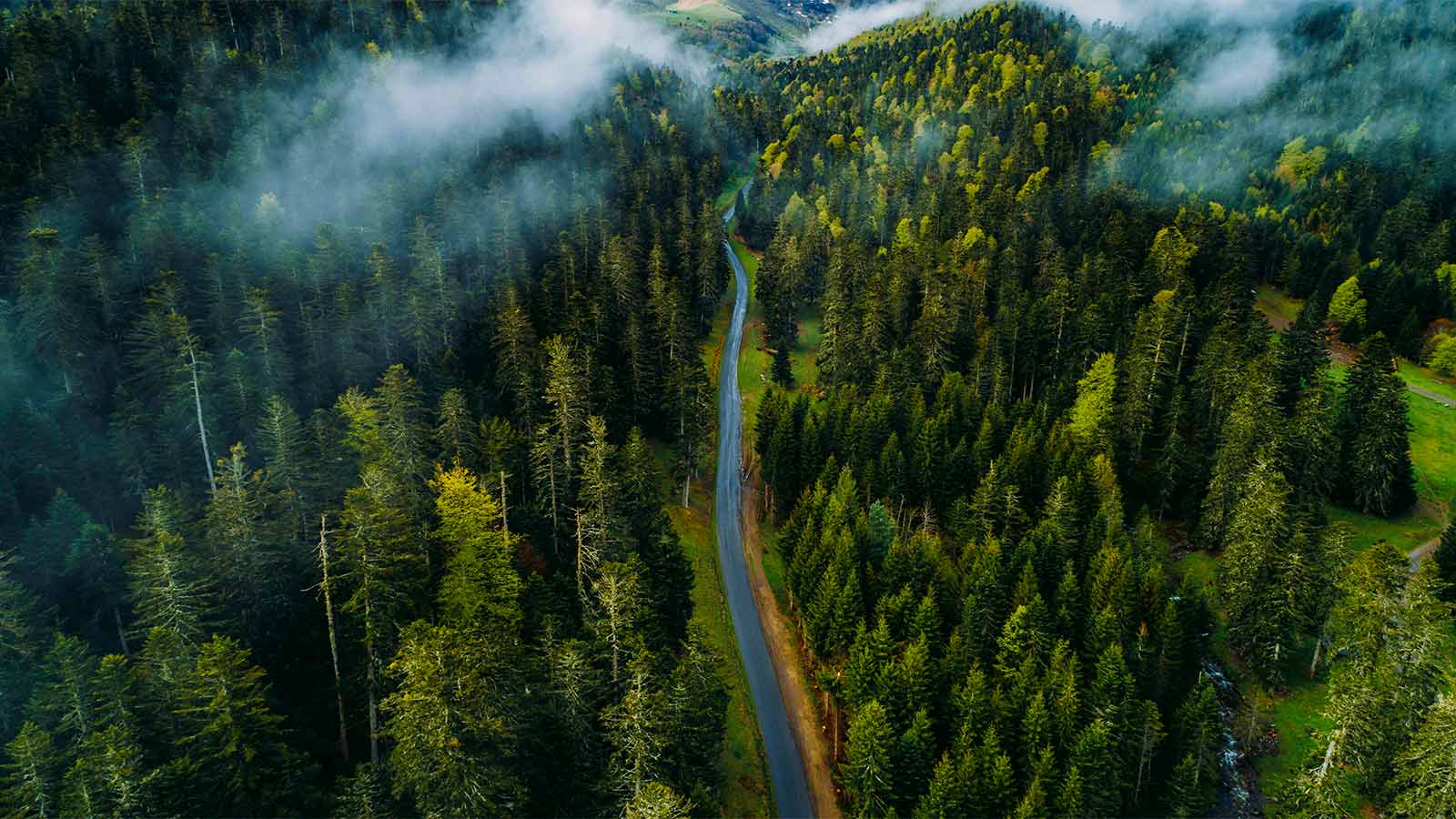

Find a sustainability-themed fund that suits you

In sustainability-themed funds, the environment and social responsibility play a key role in the selection of investment options. Through our actively managed thematic funds, you can invest globally in companies that aim to combat environmental and societal risks or promote human wellbeing. Through funds, you can also add companies to your portfolio that have a lower than average carbon footprint or operators that are among the best in their industry in terms of sustainability and corporate responsibility.

Globally investing equity funds

The OP-Climate fund invests in companies whose products and services aim to mitigate climate change or its impacts. The OP-Clean Water fund focuses on companies that seek to secure access to potable water in the future. The OP-Sustainable Wellbeing fund in turn invests in companies that have an impact on the wellbeing of societies and people. The OP-Low-carbon World fund excludes companies engaged in fossil fuel-related business activities.

A combination of fixed income and equity investments

The OP-Sustainable World fund invests in both equity and fixed income markets. Its special feature is ethical principles, which are used to exclude a large number of controversial industries, from tobacco to gambling and weapons manufacturing.

Sustainability-themed funds

This is a marketing communication. OP Fund Management Company Ltd and OP Asset Management Ltd have prepared this material as background information. The information presented in the material is based on sources that the authors consider reliable. However, the authors cannot guarantee that the provided information or opinions are correct or complete. This material is not intended to provide, and cannot be regarded as, a comprehensive and complete description of the product and the risks involved. Although the material has been prepared with care, and the aim has been to ensure that all the presented information is accurate, the authors and their employees assume no responsibility for the content of the material, and no decisions or agreements should be made based on it.

This material does not include a binding offer or proposal to buy or subscribe for a fund unit, nor does the material or its content form a basis for any agreement or commitments.

OP Pohjola's mutual funds are managed by OP Fund Management Company Ltd, which is a fund management company and alternative investment fund manager licensed by the Finnish Financial Supervisory Authority. The portfolio manager of OP Pohola's mutual funds is the portfolio management company specified in the fund prospectus for OP funds. Investments always involve risks. The value of investments can rise and fall, and the investor may lose part of or all the invested funds. Past performance does not predict future returns. The potential future performance is subject to taxation which depends on the personal situation of each investor and which may change in the future. If the mutual fund is marketed outside Finland, OP Fund Management Company Ltd may decide to end such marketing. Before making an investment decision, take all the characteristics or objectives of the fund into consideration, as described in the fund prospectus for OP Pohjola funds and other documents related to the mutual fund. Only make your investment decision after reading the mutual fund's Key Information Document, the funds prospectus, and the rules of the fund. These are available from your asset manager or at op.fi/all-funds. The main risks associated with mutual funds can be found in the Key Information Document, and a more detailed list of risks is presented in the funds prospectus. A summary of investors' rights can be found at op.fi/fund-publications. These documents are available in Finnish, Swedish and English. Copying, publishing or distributing this material to a third party in full or in part is not permitted without written permission from OP. By accepting this material, you agree to follow the instructions and restrictions above.

This material is a translation. If there are any discrepancies between the translation and the original Finnish material, the Finnish material shall prevail.