Lån - Ansök om lån för alla slags situationer

När du behöver lån har vi ett lämpligt alternativ. Du kan ansöka om lån för att köpa en bostad eller stuga, en bil eller båt, för renovering eller för att finansiera dina studier.

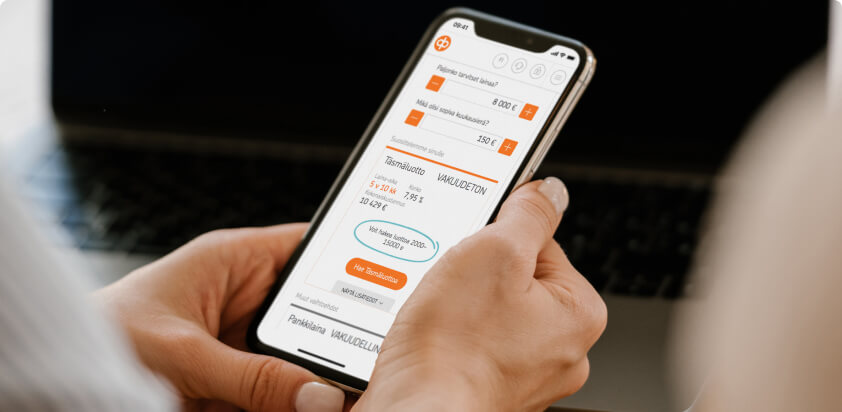

Kredit på 2 000–30 000 euro utan säkerheter eller borgensmän. Kreditbeslut på nätet.

Ett lån med säkerhet från 20 000 euro uppåt.

Bostad, fritidsbostad eller placeringsbostad.

Konkurrensutsättning eller flytt av bolån.

Återbetalning av husbolagslån.

Ansök om studielån på nätet så sparar du expeditionskostnader.

Ägarkunder får förmåner för studielån

Trygg och flexibel bilfinansiering.

Du kan köpa en bil i en bilaffär eller av en privatperson.

Lån för ytlig renovering, inredning, energirenovering och totalrenovering.

Ansök om lån eller finansiering direkt från våra samarbetsföretag.

Ansök om lån under planeringsskedet.

Om du är ägarkund hos andelsbanken samlar du OP-bonus för ditt lån.