Sijoituspohjainen kassanhallinta

Parempaa tuottoa yrityksesi rahoille fiksulla kassanhallinnalla.Laita yrityksen rahat töihin helposti ja nopeasti

Maksuton palvelu sijoittaa yrityksen tai yhteisön ylimääräiset rahat automaattisesti valitsemiisi rahastoihin tavoittelemaan tuottoa. Automatiikka huolehtii, että yrityksen tilillä on aina rahaa juoksevia kuluja varten.

Vaivatonta sijoittamista yrityksellesi sopivalla riskitasolla

Sijoituspohjainen kassanhallinta sopii niin isoille kuin pienille yrityksille. Palvelu auttaa sinua valitsemaan laajasti hajautetut korko- ja indeksirahastot sopivalla riskitasolla. Kokeneemmat sijoittajat voivat valita salkkuun myös erikoisempia rahastoja.

Matalat sijoittamisen kulut maksuttoman palvelun ansiosta

Sijoituspohjainen kassanhallinta on ilmainen palvelu, jonka otat käyttöön helposti op.fi-palvelussa. Sinun maksettavaksi jää vain rahastojen kulut.

Tilillä olevat rahat tuottamaan maksuvalmiudesta tinkimättä

Kun yrityksesi tilillä on rahaa enemmän kuin kahden kuukauden asioiden hoito vaatii, kannattaa rahat siirtää tavoittelemaan tuottoa. Sijoituspohjainen kassanhallinta huolehtii yrityksesi maksuvalmiudesta ja antaa yrityksen rahoille mahdollisuuden tuottaa ja kasvaa.

Yrityksesi tilillä on aina riittävästi rahaa juokseviin menoihin automatiikan ansioista. Jos tilin saldo alittaa määrittämäsi palautusrajan, palvelu myy rahastoja ja siirtää rahat tilille. Rahastojen myynnit käynnistyvät kolmen päivän välein, edellisen myynnin maksupäivästä alkaen.

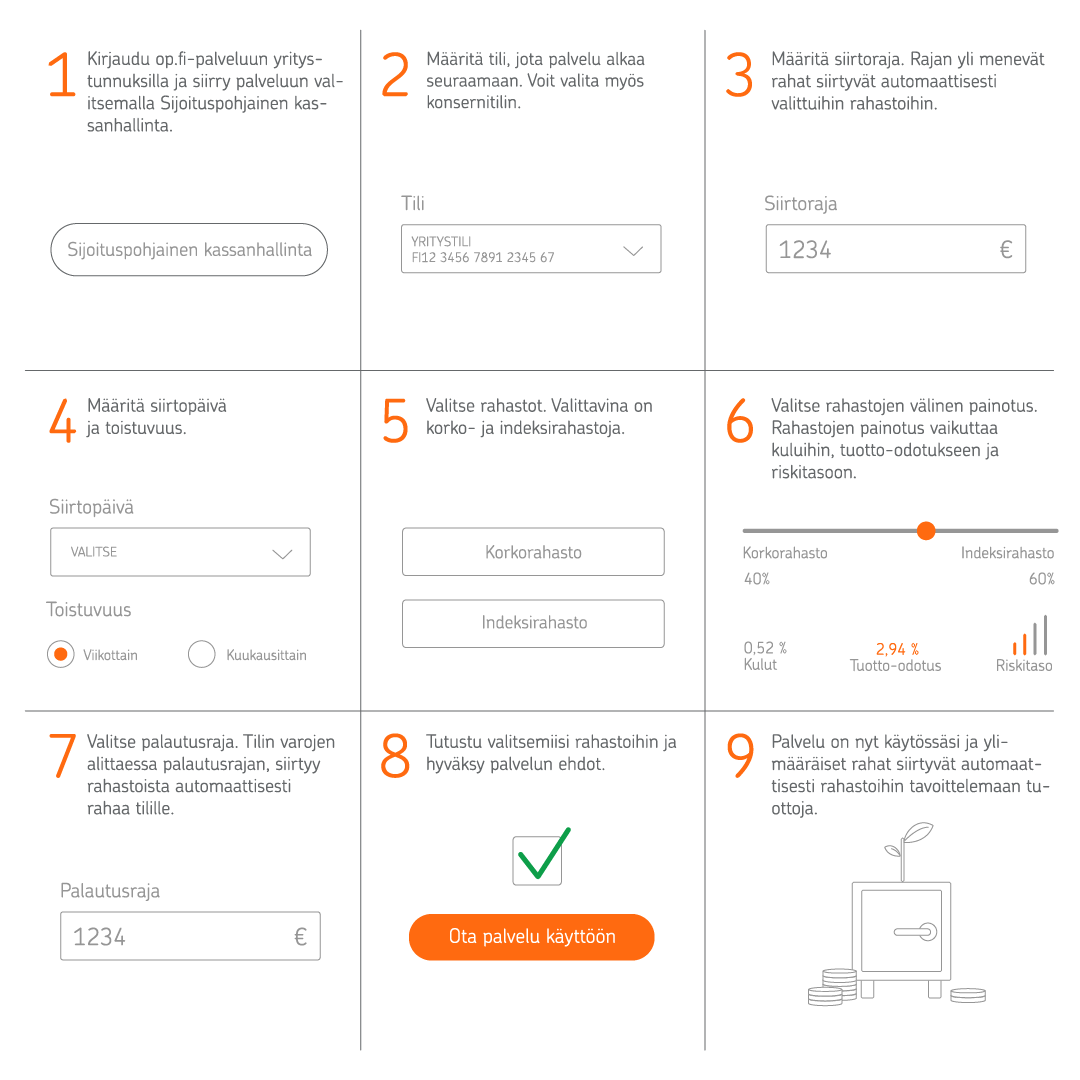

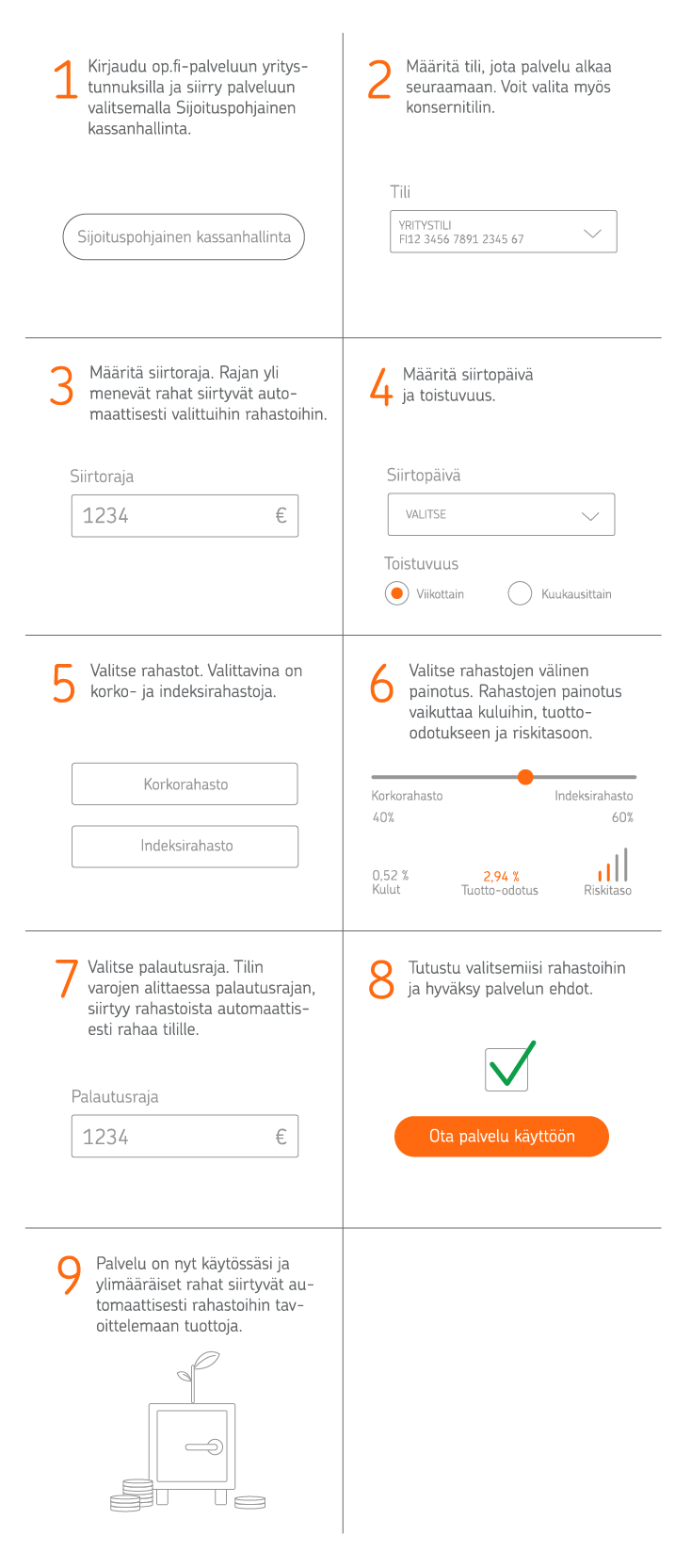

Näin otat sijoituspohjaisen kassanhallinnan käyttöön

Jos yrityksesi ei ole vielä asiakkaamme, tai yritykseltä puuttuu säästämisen ja sijoittamisen sopimus, soita meille 010 005 151 ja varaa aika sijoittamisen asiantuntijalle.

Jos yrityksesi on jo asiakkaanamme ja sillä on säästämisen ja sijoittamisen sopimus, voit ottaa palvelun käyttöön näin:

Sijoita yrityksen rahat korko- ja indeksirahastoon

Sijoituspohjaisesta kassanhallinnasta löydät laajan valikoiman yrityksen kassanhallintaan sopivia maltillisen riskin korkorahastoja sekä riskipitoisempia, osakemarkkinoille sijoittavia indeksirahastoja. Mitä isomman riskin voit ottaa, sitä isommat voivat olla mahdolliset tuotot.

Voit itse määritellä painotuksen korkorahaston ja indeksirahaston välille, jonka perusteella sijoitusten kokonaisriskitaso muodostuu. Palvelu ostaa automaattisesti valitsemiasi rahastoja antamasi painotuksen mukaan.

Sijoituksesi hajautetaan ajallisesti, laadullisesti ja maantieteellisesti

Sijoituspohjainen kassanhallinta toteuttaa automaattisesti kolmea tärkeää sijoittamisen periaatetta – ajallista, laadullista ja maantieteellistä hajautusta. Ylimääräiset rahat tilillä siirtyvät automaattisesti pienissä erissä tavoittelemaan tuottoa rahastoista, jolloin ajallinen hajautus toteutuu tehokkaasti. Palvelun rahastot sijoittavat eri puolille maailmaa ja erilaisille toimialoille, mikä taas tarkoittaa tehokasta laadullista ja maantieteellistä hajautusta.

Sinun päätettäväksi jää minkälaista tuottoa haluat tavoitella yrityksesi rahoille. Haluatko turvata yrityksen varat korkosijoituksilla vai kiinnostaako paremmat tuotot osakemarkkinoihin sijoittavilta indeksirahastoilta?

Kassanhallintaan soveltuvat korkorahastot

Osakeindeksien mukaisesti sijoittavat rahastot

Tämä on mainos. OP-Rahastoyhtiö Oy ja OP Varainhoito Oy ovat laatineet tämän materiaalin taustainformaatioksi. Materiaalissa esitetyt tiedot perustuvat lähteisiin, joita laatijat pitävät luotettavina. Takuita materiaaliin sisällytettyjen tietojen tai mielipiteiden oikeellisuudesta tai täydellisyydestä ei voida kuitenkaan antaa. Materiaalin tarkoituksena ei ole, eikä vastaanottaja voi olettaa, että se antaisi kattavan tai täydellisen kuvauksen tuotteesta ja siihen liittyvistä riskeistä. Vaikka materiaalin laadinnassa on noudatettu huolellisuutta ja pyritty varmistamaan, että kaikki siinä esitetyt tiedot ovat oikein, eivät laatija tai sen henkilökunta vastaa materiaalin sisällöstä eikä mitään päätöksiä tai sopimuksia tule tehdä sen perusteella. Tämä materiaali ei sisällä sitovaa tarjousta tai ehdotusta ostaa tai merkitä rahasto-osuutta, eikä materiaali tai sen sisältö luo perustaa millekään sopimukselle tai sitoumukselle.

OP Pohjolan sijoitusrahastoja hallinnoi OP-Rahastoyhtiö Oy, jolla on Finanssivalvonnan myöntämä rahastoyhtiön ja vaihtoehtorahastojen hoitajan toimilupa. OP Pohjolan sijoitusrahastojen salkunhoidosta vastaa OP Pohjolan rahastojen rahastoesitteessä yksilöity salkunhoitoyhteisö. Sijoittamiseen liittyy aina riskejä. Sijoitusten arvo voi nousta ja laskea, ja sijoittaja voi menettää sijoittamansa pääoman osittain tai kokonaan. Tulevia tuottoja ei voida päätellä aiemmasta tuloksesta. Mahdollinen tuleva tulos riippuu myös verotuksesta, joka puolestaan riippuu kunkin sijoittajan henkilökohtaisesta tilanteesta ja voi muuttua jatkossa. Jos sijoitusrahastoa markkinoidaan ulkomailla, voi OP-Rahastoyhtiö Oy päättää lopettaa tällaisen markkinoinnin. Sijoittamista koskevassa päätöksessä on otettava huomioon kaikki sijoitusrahaston ominaisuudet tai tavoitteet, jotka kuvataan OP Pohjolan rahastojen rahastoesitteessä ja muissa sijoitusrahastoa koskevissa asiakirjoissa. Tutustu ennen sijoituspäätöstä sijoitusrahaston avaintietoasiakirjaan, rahastoesitteeseen ja sääntöihin. Saat ne varainhoitajaltasi tai osoitteesta op.fi/kaikki-rahastot. Sijoitusrahaston pääasialliset riskit löytyvät avaintietoasiakirjasta ja täydellisempi riskiluettelo rahastoesitteestä. Tiivistelmä sijoittajan oikeuksista on osoitteessa op.fi/tutustu-rahastojulkaisuihin. Asiakirjat ovat suomeksi, ruotsiksi ja englanniksi.

Tämän materiaalin kopioiminen, julkaiseminen tai levittäminen kolmannelle taholle kokonaisena tai osittain ei ole sallittua ilman OP Pohjolan kirjallista lupaa. Ottamalla vastaan tämän materiaalin sitoudutte noudattamaan edellä mainittuja ohjeita ja rajoituksia.