Loans - Apply for a loan for all sorts of situations

Need a loan? We have the right option for you. You can apply for a loan to buy a home or holiday cabin, purchase a car or boat, make home improvements, or finance your studies.

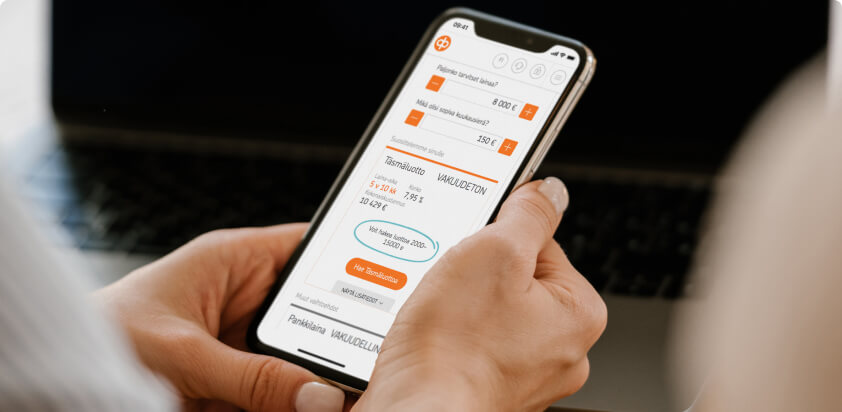

A loan of 2,000 to 30,000 euros without collateral or a guarantor. Online credit decision.

Secured loans start from 20,000 euros.

Home, holiday home or buy-to-let home.

Transferring or shopping for a home loan.

Paying off housing company loan.

Apply for a student loan online and save on service charges.

Student loan benefits for owner-customers.

Safe and flexible car finance.

You can buy the car from a dealer or private person.

Loan for redecorating, refurbishing, energy renovations or for renovating your home.

Apply for a loan, or seek financing directly from one of our partner retailers.

Apply for loan in the planning phase.

If you are an OP cooperative bank owner-customer, your loan will earn you OP bonuses.